Just a year after a settlement went into effect between state regulators and representatives of the insurance industry on an increase in dwelling policy rates, another request has been filed for coverage of rental properties that would top 70% over two years on the Outer Banks.

The N.C. Rate Bureau is seeking a statewide average total increase of 68.3% in dwelling insurance rates by 2027.

The Rate Bureau, which represents insurers and operates independently from the state Department of Insurance — cited a number of factors that are driving the latest request.

“The N.C. Rate Bureau reviewed data on tens of thousands of actual insurance claims from 2019 through 2023 to determine the premiums needed to cover risks and build this request,” according to a statement.

“We’ve asked for a substantial increase in the dwelling rate because claim costs have increased substantially,” the Rate Bureau said. “Simply put, severe storm damage is becoming more common, it’s impacting more homes, and it’s more expensive to rebuild afterwards.”

The Rate Bureau noted the request has to be balanced between trying to keep insurance affordable, cover risk and encourage a large number of competitors in the state.

“Once again, North Carolina property owners are facing the prospect of substantial double-digit rate increases, not just for one year but consecutively for two years,” said Outer Banks Association of Realtors Government Affairs Director Donna Creef.

“Property owners have barely had time to recover from the last increases that became effective on November 1, 2024, just over 12 months ago,” Creef said. “This is especially impactful for property owners in Dare County because we have a large number of second homes and rental homes.”

Dwelling policies generally cover rental properties owned by landlords as well as vacation homes, as opposed to primary homes that the owner lives in.

Primary homes are covered by homeowners’ policies, which saw a base rate increases that began earlier this year, and will rise again next June.

In June 2024, a settlement between state Insurance Commissioner Mike Causey and the Rate Bureau went into effect on a dwelling policy increase that averaged 8% statewide, after the industry initially asked for a 50.6% increase.

Under the dwelling proposal filed October 30, rates would rise in two stages: a statewide average of 28.5% on July 1, 2026, followed by 30.9% on July 1, 2027.

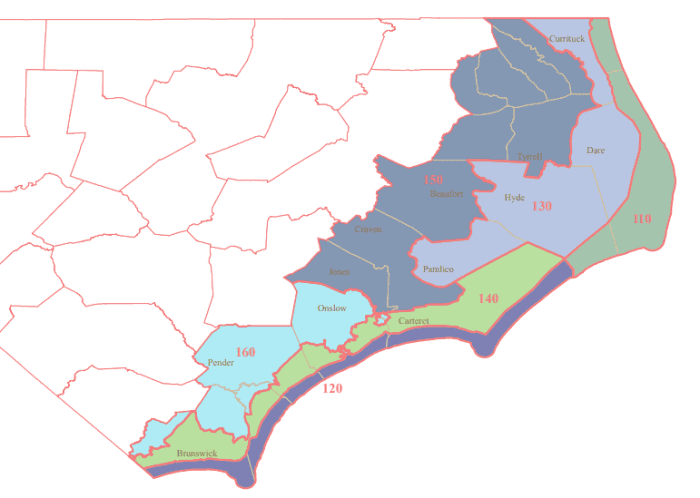

According to an analysis by Creef, in Territory 110, which runs from Carova to Ocracoke, the cost of a policy that provides $15,000 coverage would be $99.59 higher in 2026 and $140.72 higher in 2027.

That represents annual hikes of roughly 27% and 38%, respectively.

For Territory 130, covering mainland Dare, Currituck and Hyde counties, the increase on a $15,000 policy is $58.54 for 2026, and $148.88 for 2027, increases of approximately 18% and 46%.

The Rate Bureau said the proposed filing sets a ceiling on what insurers can charge, but actual premiums will vary by location, company and individual property risk.

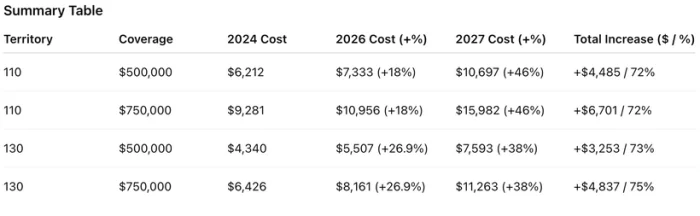

A local insurance agent said the typical current annual cost of $500,000 of coverage for a rental home in Nags Head (Territory 110) is $6,212, and $750,000 of coverage runs $9,281.

In Grandy (Territory 130), the cost of a $500,000 policy is $4,340, and for $750,000 it’s $6,426.

How the rate request filing would impact those policies:

The agent noted those policies did not include contents coverage, and the fire protection class in Nags Head is rated better than in Grandy, all which have an impact on cost.

“Climate change is here, and so are the financial costs from it,” the Rate Bureau said in their statement, citing 27 separate billion-dollar disasters across the United States in 2024, one behind the record set in 2023.

“Adding to these costs: Inflation in the construction industry has far out-paced overall inflation in recent years, and some of the fastest growing areas in North Carolina are coastal areas where storm damage is more common,” the Rate Bureau said.

“I encourage property owners and residents to submit public comments…requesting (Causey) to make the determination that these back to back rate increases are unreasonable,” Creef said. “Certainly they seem unreasonable to me.”

Those wanting to comment on the rate request have until November 19 to do so, either by 2025DwellingandFire@ncdoi.gov or in writing to Kimberly W. Pearce, Paralegal III, 1201 Mail Service Center, Raleigh, N.C. 27699-1201.

All public comments will be shared with the N.C. Rate Bureau. If the Department of Insurance officials do not agree with the requested rates, the department will negotiate with the Rate Bureau. If a settlement cannot be reached within 50 days, a hearing will be called.

The post Another insurance rate hike sought for rental houses in North Carolina appeared first on Island Free Press.

Add to favorites

Add to favoritesCredit: Original content published here.